Car Insurance Quotes money super market

Car Insurance Quotes with money super market introduction.

Here’s an introduction for a blog post or article that incorporates car insurance quotes from moneysupermarket.com:

Introduction: Finding Affordable Car Insurance Quotes with MoneySuperMarket

Impact-Site-Verification: 8f28d0d7-f9f3-4174-bc95-9320fff4eab3

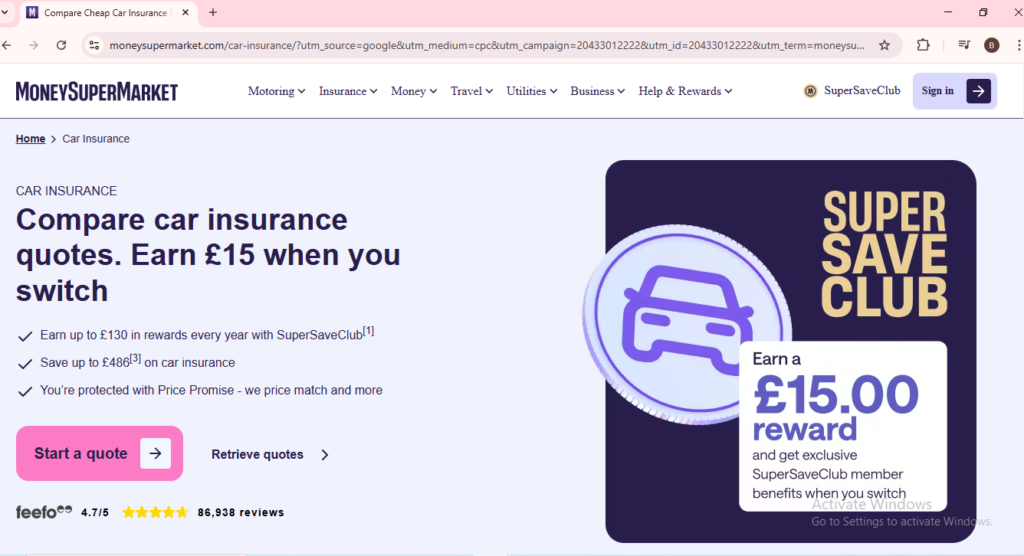

When it comes to getting the best deal on car insurance, shopping around and comparing car insurance quotes is essential. One of the best ways to find competitive prices and a variety of options is through a comparison site like MoneySuperMarket.com. With its user-friendly platform, MoneySuperMarket helps you quickly compare quotes from multiple insurance providers, ensuring you find coverage that fits both your budget and your needs. Whether you’re looking for comprehensive coverage, third-party liability, or something in between, using a site like MoneySuperMarket can save you time and money by presenting a wide range of choices at your fingertips.

As a SuperSaveClub member, you can now earn up to 10% cashback when you shop at dozens of top brands via us.

In this guide, we’ll take a look at how MoneySuperMarket.com can help you get the best car insurance quotes and explore tips for making the most of the comparison process to secure the right policy for you.

This introduction provides a clear, informative overview of how MoneySuperMarket.com can assist with finding affordable car insurance quotes while encouraging readers to explore further. If you need more details or adjustments, feel free to ask!

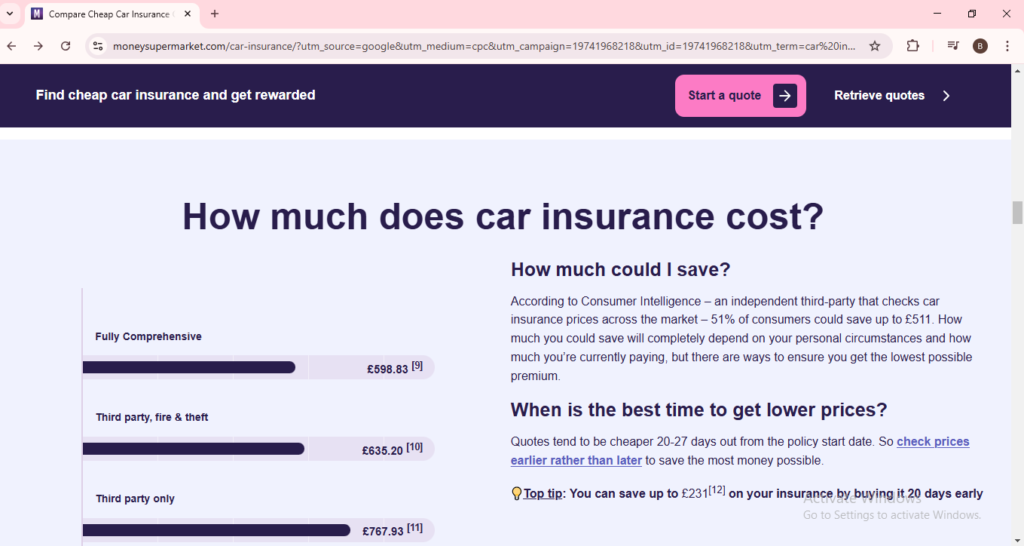

Pricing & Affordability: How Much Should You Expect to Pay for Car Insurance?

When it comes to getting car insurance quotes, one of the most important factors you’ll want to consider is pricing and affordability. Car insurance costs can vary significantly based on a range of factors, from the type of coverage you choose to personal details like your driving history, age, and location. Understanding these variables can help you get a better idea of how much you might pay for your policy.

Factors That Affect Your Car Insurance Premium

- Driving History

A clean driving record generally leads to lower premiums. Insurers consider factors like accidents, tickets, and claims history. If you’ve been in an accident or have traffic violations on your record, you might see higher rates. Image suggestion: Include a graphic comparing rates for drivers with clean records vs. those with accidents or violations. - Age and Gender

Younger drivers, particularly those under 25, tend to pay higher rates because they’re statistically more likely to be involved in accidents. Gender can also play a role, with young male drivers often paying higher premiums than their female counterparts. - Vehicle Type

The make, model, and age of your vehicle also impact your premium. Sports cars or high-performance vehicles typically cost more to insure due to their higher repair costs and increased risk of theft. On the other hand, safer vehicles with high safety ratings might lead to discounts. Image suggestion: A chart comparing insurance costs for different types of vehicles (e.g., luxury cars vs. family sedans). - Location

Where you live matters. Insurance companies base premiums on regional risk factors such as theft rates, weather conditions, and accident statistics. If you live in a city with high traffic or a region prone to severe weather, your insurance rates may be higher. - Coverage Type

The level of coverage you choose is one of the most direct ways to influence your premium. Liability coverage tends to be more affordable than comprehensive or collision coverage because it covers only the other driver’s costs in an accident, not your own vehicle. Image suggestion: A simple infographic showing different types of car insurance coverage and their typical costs. - Credit Score

While not all states allow insurers to factor in your credit score, many do. A higher credit score often translates to lower rates, as insurers associate good credit with responsible behavior

Average Cost of Car Insurance

The average cost of car insurance in the U.S. varies but typically falls between $1,000 and $1,500 per year for a full coverage policy. However, the exact cost can vary widely based on the factors mentioned above. For example, a 30-year-old with a clean driving record might pay around $1,200 annually, while a 20-year-old with a recent accident could see rates closer to $2,000 or more.

How to Find Affordable Car Insurance Quotes

To make sure you’re getting a good deal, it’s essential to shop around and compare car insurance quotes from different providers. Keep in mind that the cheapest option might not always provide the best value. Consider the level of coverage, customer service, and the company’s reputation for handling claims.

- Bundle your policies: Many insurers offer discounts if you purchase multiple policies (e.g., home and auto insurance) from them.

- Increase your deductible: Raising your deductible can lower your monthly premium, but make sure you can afford the out-of-pocket cost if you need to file a claim.

- Take advantage of discounts: Look for discounts for safe driving, low mileage, or being a member of certain organizations.

Conclusion

The cost of car insurance is determined by a variety of factors, and understanding these can help you make more informed decisions when comparing car insurance quotes. While it’s important to find a policy that fits your budget, don’t forget that the cheapest option might not always be the best coverage for your needs. By considering the factors that impact your premium and shopping around, you can find the right balance of price and protection.

Discounts & Savings: Ways to Lower Your Car Insurance Premium

When searching for car insurance quotes, many drivers are looking for ways to reduce their premiums without sacrificing essential coverage. Thankfully, most insurance companies offer a variety of discounts that can help you save money. By taking advantage of these discounts and adopting certain strategies, you can significantly lower your car insurance costs. Here’s how:

Common Car Insurance Discounts You Might Qualify For

- Safe Driver Discount

If you have a clean driving record with no accidents or traffic violations, many insurers offer a safe driver discount. Insurers reward responsible drivers with lower rates as they’re considered less risky to insure. This discount is often given after maintaining a certain period (usually 3–5 years) of safe driving. Image suggestion: A comparison chart showing how premiums drop for drivers with clean records versus those with violations. - Multi-Policy Discount

Bundling your car insurance with other policies (like home, renters, or life insurance) is one of the easiest ways to save money. Many insurers offer significant discounts if you have multiple policies with them. This not only lowers your car insurance quotes but also makes managing your policies simpler. - Good Student Discount

If you’re a student (or have a student driver), many insurers offer discounts for good grades. A “B” average or higher can qualify you for a discount, as it shows that you are responsible and likely to drive safely. Parents can also benefit from this discount by adding their young drivers to the policy. Image suggestion: A visual showing a “good student” with a report card and how it can lead to savings on premiums. - Low Mileage Discount

If you don’t drive much, you may be eligible for a low mileage discount. Insurance companies typically offer this discount to drivers who use their car less frequently, as lower mileage reduces the risk of accidents. This is particularly beneficial for people who work from home or don’t commute long distances. - Anti-Theft and Safety Feature Discounts

Many modern cars come equipped with advanced safety features, such as anti-theft systems, airbags, and automatic braking. Insurance providers often offer discounts for these features because they reduce the likelihood of accidents or theft. Similarly, if you install a tracking device or an alarm system in an older car, you could see savings on your premiums. - Pay-Per-Mile or Usage-Based Insurance

Some insurance companies now offer pay-per-mile or usage-based insurance, where your premium is based on how much you drive. If you drive infrequently or have a short daily commute, this type of policy could save you money. The insurer will track your driving habits using a device installed in your vehicle or through a mobile app. - Multi-Car Discount

If you insure more than one vehicle with the same company, you can often qualify for a multi-car discount. The more cars you insure under a single policy, the bigger the discount you may receive. This can be an excellent option for families or households with multiple vehicles. - Paid-in-Full Discount

If you can pay your car insurance premium in full for the year (rather than in monthly installments), many insurers will offer a discount. This is because they don’t have to deal with processing monthly payments, and you’re committing to the policy for a full year. - New Car Discount

If you’re insuring a brand-new vehicle, some insurers offer a new car discount. Newer cars are generally considered safer and less likely to need expensive repairs, so they can sometimes be cheaper to insure than older models.

How to Maximize Your Savings on Car Insurance

While these discounts are a great starting point, there are a few more ways you can maximize your savings:

- Compare car insurance quotes from multiple providers. Rates can vary significantly from one insurer to another, so it’s always a good idea to shop around.

- Review your coverage regularly. If your car is getting older or has a lower market value, you might want to reduce your comprehensive or collision coverage. This could lower your premium without sacrificing too much protection.

- Improve your credit score. Many insurers use your credit score to determine your premium. Maintaining or improving your credit score can lead to lower rates.

- Take a defensive driving course. Some insurers offer discounts if you complete an approved defensive driving course. This shows insurers that you are committed to improving your driving skills.

Conclusion

Customer Service & Claims Process: How Easy Is It to Get Help and File a Claim?

When choosing a car insurance provider, price isn’t the only thing that matters. A key factor in your decision should be the quality of customer service and the ease of the claims process. After all, when accidents happen, you want to be sure you’re dealing with a responsive and reliable insurer. Here’s a breakdown of what to look for in customer service and claims handling when comparing car insurance quotes.

Importance of Good Customer Service

The level of customer service provided by your insurance company can greatly impact your experience, especially in stressful situations like filing a claim after an accident. Some insurers offer 24/7 customer support, while others may only be available during business hours. When considering car insurance, it’s important to evaluate how easy it is to reach customer service and how quickly they respond to inquiries.

Look for insurers with:

- Multiple contact channels: Whether it’s by phone, email, or live chat, the more ways you can get in touch with customer support, the better.

- Responsive agents: A fast response time is crucial, especially in emergency situations. Read customer reviews to get an idea of how quickly and effectively an insurer resolves issues.

- Helpfulness and professionalism: Customer service representatives should be knowledgeable, friendly, and capable of resolving issues quickly.

The Claims Process: What to Expect

Filing a claim can be one of the most stressful aspects of car insurance, but a streamlined, straightforward process can make a big difference. Here are some key aspects to consider when comparing car insurance quotes based on claims handling:

- Ease of Filing a Claim

Many insurance companies now allow you to file claims online or through a mobile app. This can speed up the process and give you access to your claim status at any time. Look for insurers that offer simple, user-friendly claim submission processes, especially if you prefer handling things digitally. Image suggestion: An infographic showing the steps to file a claim—whether via app, website, or by phone. - Claim Processing Time

Different insurers handle claims at different speeds. The quicker the claim is processed, the sooner you can get your vehicle repaired or replaced. Look for reviews or ask your insurance provider about their average claim settlement time. A company with a strong reputation for fast and fair claims processing is a good indicator of reliability. - Claims Payouts

The claims process isn’t just about filing—it’s also about how the insurer settles the claim. Some insurers are known for offering quick payouts, while others may delay or complicate the process. Ensure your insurer is transparent about their claims handling and gives you an accurate estimate of the payout timeframe. Image suggestion: A timeline showing how long it typically takes for a claim to be processed and paid out. - Claims Support and Follow-Up

Good insurers don’t just leave you in the dark after a claim is filed. They should provide regular updates on the status of your claim and offer support through every step of the process. Check if your insurer provides an online portal or mobile app where you can track the progress of your claim. - Dispute Resolution

Occasionally, there may be disagreements regarding the payout or coverage. In these cases, it’s important to know the process for resolving disputes. A company with a clear and fair dispute resolution policy will ensure that any disagreements are addressed in a timely manner.

How to Evaluate Customer Service & Claims Process

When you’re comparing car insurance quotes, don’t just focus on the price. Make sure you’re considering the overall experience, including how well the insurer handles customer service and claims. Here are a few ways to evaluate these aspects:

- Read customer reviews: Websites like Trustpilot, Google Reviews, or the Better Business Bureau can provide valuable insights into an insurer’s reputation for customer service and claims handling.

- Check ratings: Organizations like J.D. Power and Consumer Reports rank insurers based on customer satisfaction, which includes claims satisfaction. A high rating in this area can be an indicator of great service.

- Call customer support: Before committing to a policy, consider calling the insurer’s customer service line. This can help you gauge how quickly they respond and how helpful the agents are.

- Request information on the claims process: Ask your potential insurer about their claims process—how to file, typical timelines, and what support is available.

Conclusion

When you’re comparing car insurance quotes, it’s crucial to not only look at the price but also assess the level of customer service and the claims process. Having quick access to knowledgeable support and a smooth, fast claims experience can make all the difference when you need help the most. Be sure to read reviews, check claims processing times, and evaluate the customer service offerings to ensure you choose an insurer that delivers on both affordability and reliability.

Financial Stability & Reputation: Trustworthy Insurers You Can Rely On

Here’s the content for Financial Stability & Reputation: Trustworthy Insurers You Can Rely On:

Financial Stability & Reputation: Trustworthy Insurers You Can Rely On

When searching for car insurance quotes, it’s easy to focus on the price and coverage options. However, one of the most important factors to consider is the financial stability and reputation of the insurer. After all, an insurance company’s ability to pay out claims when needed depends on its financial health. Here’s why these aspects matter and how to evaluate an insurer’s reliability before purchasing a policy.

Why Financial Stability Matters

The financial strength of an insurance company indicates its ability to meet its financial obligations, including paying claims. A stable insurer is less likely to face financial difficulties that could delay or prevent you from receiving a payout in the event of a claim. Car insurance quotes from financially strong companies offer more security for policyholders because these insurers are better positioned to weather economic downturns and manage risk.

Insurance companies are rated for financial stability by independent agencies like:

- A.M. Best

- Standard & Poor’s (S&P)

- Moody’s

These agencies assign ratings to insurers based on their financial health. Companies with an “A” rating or higher are generally considered financially strong and more reliable. When comparing car insurance quotes, check the insurer’s financial ratings to ensure they have the resources to back up their promises.

Image suggestion: A graphic showing A.M. Best, S&P, and Moody’s rating scales and what they mean for consumers.

How to Check an Insurer’s Financial Stability

- Look at Industry Ratings

As mentioned, organizations like A.M. Best provide detailed ratings on the financial strength of insurance companies. These ratings help you assess whether an insurer has the financial resources to pay out claims. An insurer with a high rating (A or better) is generally considered reliable and well-capitalized. - Review Claims Payout History

A good way to assess financial stability is to look at the insurer’s claims history. Insurers with a reputation for paying claims promptly are likely to have strong financials. Research reviews and reports from credible sources to see how well the company handles claims during tough economic times. - Check for Legal and Financial Issues

Ensure the insurer has no significant legal or financial problems that could affect their ability to pay claims. Look for any bankruptcy filings, lawsuits, or regulatory issues that might indicate the company is in financial trouble. - Consider the Insurer’s Size and Market Share

Larger insurers with a significant market share are often more financially secure. These companies typically have a diversified portfolio of policies and clients, which can help them stay financially stable, even in the face of large claims. Image suggestion: A chart comparing the financial ratings of top insurers and their market share.

Reputation: Trustworthiness Beyond the Numbers

In addition to financial stability, the reputation of an insurer plays a critical role in ensuring you’re choosing a trustworthy provider. Reputation covers factors like customer service, claims handling, and how the company treats its policyholders.

Here are a few things to look for when evaluating an insurer’s reputation:

- Customer Reviews and Satisfaction

Customer reviews are a valuable resource when assessing the reputation of a car insurance company. Websites like Trustpilot, Consumer Reports, and the Better Business Bureau (BBB) provide real customer feedback about an insurer’s customer service, claims process, and overall satisfaction. High ratings in these areas are a good indicator of a trustworthy insurer. - Industry Awards and Recognitions

Many insurance companies receive industry awards for excellence in areas like customer service, claims handling, and overall satisfaction. Awards from independent organizations, like J.D. Power and Consumer Reports, can give you insight into how well a company performs relative to its competitors. - Claims Experience

A company’s reputation for claims handling is often what distinguishes a great insurer from an average one. Even with a great price, a bad claims experience can leave you frustrated. Look for companies that consistently receive high marks for easy claims filing, fast payouts, and effective dispute resolution. Image suggestion: An infographic highlighting customer satisfaction ratings and top awards received by leading insurers. - Longevity in the Market

The longer an insurance company has been in business, the more likely they are to have a solid reputation. Companies with a long track record of handling claims and serving customers tend to be more reliable and established in the market. A company’s longevity often reflects its ability to successfully navigate financial challenges and build customer trust.

Conclusion

When comparing car insurance quotes, it’s crucial to consider the financial stability and reputation of the insurer. A financially secure company with strong ratings from independent agencies will be better equipped to handle claims and honor its commitments. Additionally, a solid reputation for customer service and claims handling ensures that you’ll have a smooth experience when you need it most. By choosing a trustworthy insurer, you’re not just securing affordable coverage—you’re securing peace of mind.

Certainly! Here’s a Pros & Cons breakdown for the topic Financial Stability & Reputation: Trustworthy Insurers You Can Rely On:

Pros of Choosing Financially Stable and Well-Respected Insurers

- Reliable Claims Payouts

- Financially stable companies are more likely to pay out claims quickly and in full, ensuring you are adequately covered when an accident or incident occurs.

- Long-Term Security

- Established insurers with strong financials offer long-term stability, meaning you don’t have to worry about your insurer going bankrupt or failing to fulfill obligations.

- Better Customer Service

- Reputable insurers often invest in high-quality customer service, providing easier communication and faster response times.

- Peace of Mind

- Knowing that your insurer is financially sound and has a good reputation offers peace of mind, especially when you’re in need of assistance or filing a claim.

- Industry Recognition and Trust

- Financially strong insurers with a solid reputation tend to earn awards and high ratings from trusted industry sources, adding credibility to their services.

Cons of Choosing Financially Stable and Well-Respected Insurers

- Potentially Higher Premiums

- Insurers with strong financial backing and a solid reputation may charge higher premiums, as they often offer more comprehensive coverage and superior claims handling.

- Limited Flexibility

- Larger, well-established insurance companies may have more rigid policies, less flexibility in coverage options, or fewer discounts compared to smaller, more agile providers.

- Less Personalization

- Big-name insurers might not offer the same personalized service or flexibility as smaller companies, which can be frustrating for customers with unique needs.

- Higher Overhead Costs

- Bigger insurers with a larger operation may have higher overhead costs, which could be passed down to customers in the form of slightly higher premiums.

- Longer Wait Times for Claims Processing

- While financially stable insurers generally have solid claims processes, larger companies might sometimes have longer wait times due to their size, particularly in peak periods.

This Pros & Cons section helps highlight the trade-offs when considering insurers with strong financial stability and a good reputation. While they offer significant benefits, there are a few drawbacks, mainly related to cost and flexibility. Let me know if you’d like to expand on any of these points!

![Read more about the article Dusk Furniture [ |2025| Ultimate Product]](https://kowtwo.com/wp-content/uploads/2025/02/Bleu-Blanc-Minimaliste-Simple-Moderne-Typographic-Ciel-Azur-Galerie-Dart-Logo-300x300.png)